At its conference on self-driving vehicles in London yesterday, the UK’s Association of British Insurers (ABI) set out the minimum criteria for a vehicle’s autonomous systems to meet the Automated and Electric Vehicle Bill’s definition of an automated vehicle.

The bill defines an automated vehicle as “A vehicle that is designed or adapted to be capable, in at least some circumstances or situations, of safely driving itself, i.e. that it is operating in a mode in which it is not being controlled, and does not need to be monitored, by an individual”.

As the regular use of self-driving vehicles on UK roads gets closer, the country’s insurers have attempted to decide what a vehicle should be capable of doing to deserve the title ‘automated’. They are also calling for data on automated functionality to be available at an individual level, via its Vehicle Identification Number, recording what software version they are using.

The ABI proposes 10 key criteria required by a true automated vehicle:

1. Naming – clearly describes automated capability;

2. Law abiding – complies with UK traffic laws and the Highway Code;

3. Location specific – functionality is limited to specific types of roads or areas via geo-fencing;

4. Clear handover – transfer of driving control follows a clear ‘offer and confirm’ process;

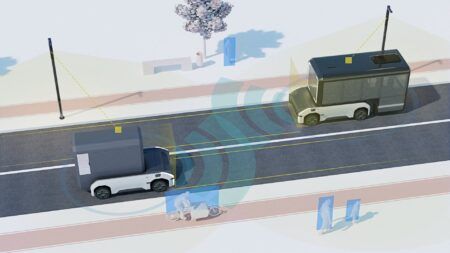

5. Safe driving – vehicle can manage all reasonably expected situations by itself;

6. Unanticipated handover – adequate and appropriate notice must be given if the vehicle needs to unexpectedly hand back driving control;

7. Safe stop – vehicle executes an appropriate ‘safe stop’ if unable to continue or the driver does not take back control;

8. Emergency intervention – vehicles can avoid or prevent an accident by responding to an emergency;

9. Back-up systems – safeguards step in if any systems fail;

10. Accident data – record and report what systems were in use at the time of an accident.

“It is crucial that there is a clear definition of what constitutes an automated vehicle,” noted Matthew Avery, director of research at Thatcham Research. “Regulators and insurers require this to classify and insure vehicles appropriately, while consumers need to understand the capability of the vehicle and their own responsibilities. Consequently, a system that needs the driver to control or monitor the vehicle in any way cannot be classified as automated.”

Ben Howarth, senior policy adviser for motor and liability at the ABI, added, “Insurers want to see manufacturers being absolutely clear about how they describe their vehicles, and we think this checklist should be adopted across the industry to help give clarity to consumers.”