The USDOT’s ITS Joint Program Office (JPO) has published a report, which shows that even if autonomous vehicles are adopted rapidly in the long-haul trucking sector, it will only lead to minimal layoffs.

The report highlighting the potential macroeconomic impacts of the adoption of higher-level automated driving systems (ADS) in the US long-haul trucking industry.

Driving automation has the potential to significantly enhance the overall productivity of the nation’s trucking industry. Yet, the department wanted to further understand the possible magnitude of such advancements for the wider US economy.

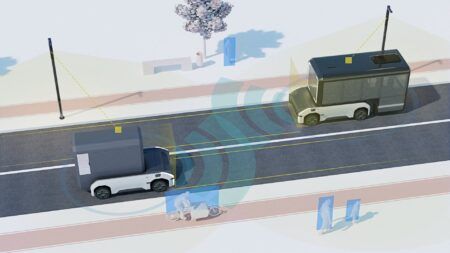

The report, Macroeconomic Impacts of Automated Driving Systems in Long-Haul Trucking, focuses on levels 4 and 5 of automation, which do not require a human driver onboard the vehicle. In addition, the report’s focus is limited to ADS in the long-haul trucking industry.

Unlike the short-haul segment, the long-haul segment involves long periods of uninterrupted highway driving (which is a less-complex environment than surface streets). Also, long-haul drivers have fewer non-driving responsibilities than short-haul drivers. Due to these factors, long-haul trucking appears to be an early candidate for ADS.

However, the timeline for adoption of ADS remains uncertain. With this in mind, the report examines three adoption scenarios – slow, medium, and fast adoption. In the fast scenario, 75% of new-vehicle purchases involve ADS in 10 years of the technology becoming available. The medium and slow scenarios assume 48% and 19% of trucking firms will have begun adopting the technology 10 years after it becomes available, respectively.

The model indicates that productivity enhancements from the adoption of ADS in the long-haul trucking sector will increase GDP, capital, employment, wages, and welfare that can be monetized into billions of dollars. Moreover, the model concludes that these economic benefits can likely be reaped without mass lay-offs of long-haul truck drivers (assuming the occupational turnover rate stays steady).

Only the fast adoption scenario showed short lived, small magnitude lay-offs – no more than 1.7% of the long-haul driver workforce is expected to be impacted annually over a five-year period.

.