Multinational professional services and accountancy network KPMG International has released the results of a new global-first benchmarking study measuring the efficiency of current tolling operators, which shows that on average they are losing US$8m per year from inefficiencies and leakage.

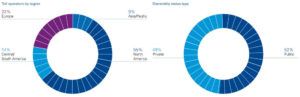

The new KPMG research demonstrates where operators may be making and losing revenue based on operating model, technology use and leakage. Comparing 65 public and private toll operators representing a total of 184 tolling facilities worldwide, the benchmark clearly shows that technology is disrupting the industry and has the power to eliminate a number of operating models if organizations do not swiftly upgrade and adapt to a new way of doing business. The report reveals that toll operators have the opportunity to be the center of a new, quickly forming mobility platform, where tolls are collected seamlessly and efficiency is prioritized. This will involve larger interoperability agreements, which 35% of respondents are open to forming. Operators will also need to begin the more complicated work of preparing for autonomous toll collection, the embrace of autonomous vehicles (AVs), and the use of collected data to transform the customer experience.

Conducted in 2018 and based on the most recent financial results for each toll operator, confidential responses were collected from organizations headquartered in 15 countries across the Americas, Europe and Asia. KPMG has discovered that only a handful of operators (five of 65 respondents) are poised to benefit from the quickly changing landscape of tolling. Leaders in the industry demonstrate the following:

- Regularly maintain a 90% margin of the total cost to collect, or US$0.24 total cost to collect;

- Removing cash from the system, with top operators using Open Road Tolling (ORT) and Electronic Toll Collection (ETC);

- Are most often private companies and less hamstrung by public services infrastructure or elected officials.

The less-efficient segment of the industry showcase how growth could become a challenge in a digitally-managed world:

The less-efficient segment of the industry showcase how growth could become a challenge in a digitally-managed world:

- Operators with less efficiency in their model reported a total cost to collect more than twice as expensive than the top quartile of efficient operators, which is often driven by manual collection methods;

- Many are relying on old technology, with only 25% using systems that are one year or less old, and 39% using technology five years or older.

“Leaders in the industry are gaining traction because they are reviewing their entire business from the ground up. They put the customer at the heart of their model and use technology to create an excellent experience that drives revenue and generates the greatest return from every dollar spent. Cutting cost isn’t the focus for these leaders; it’s about creating a world-class experience,” noted Stephen Beatty, non-executive chairman and global infrastructure head at KPMG’s City Center of Excellence. “Our data suggests there is more than US$90m that could be saved by toll operators if the lowest quarter of performers could improve operations to match the efficiency of the best-performing quarter. That’s a lot of money that could be used to improve roads and technology that improves the customer experience.”