Independent public policy research organization Reason Foundation has published a new report that examines how a state-led transition from per-gallon fuel taxes to per-mile road user charging (RUCs) could be introduced across the USA

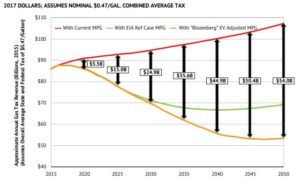

There is a growing consensus among US transportation researchers, and increasingly among state departments of transportation (DOTs), that the country’s main highway funding source, per-gallon taxes on gasoline and diesel fuel, will not be sustainable on a long-term basis. This is due to a number of factors, including increasingly stringent federal fuel economy regulations and the growth of non-petroleum power sources (especially electricity) for both personal vehicles and trucks. The Foundation’s new policy brief makes a number of points about how a state could make an orderly transition from per-gallon fuel taxes to per-mile charges. The discussion acknowledges that mileage-based user fees (MBUFs) currently lack majority support among taxpayers, motorists, and the trucking industry.

To address this challenge, the paper argues that MBUF advocates must do a number of things besides encouraging and drawing lessons from state mileage-based user fee or RUC pilot projects. Specifically, MBUF advocates should:

To address this challenge, the paper argues that MBUF advocates must do a number of things besides encouraging and drawing lessons from state mileage-based user fee or RUC pilot projects. Specifically, MBUF advocates should:

- Propose fixing all the major shortcomings of per-gallon fuel taxes, not simply projected revenue shortfalls;

- Ensure that at the time a transition program is launched, the starting point will be revenue-neutral, and that no roadway user will pay both a state fuel tax and a state MBUF;

- Restore the roadway funding mechanism to the original users-pay/users-benefit principle that underlay both the original state fuel taxes and the new federal fuel taxes that were created to pay for building the Interstate highway network;

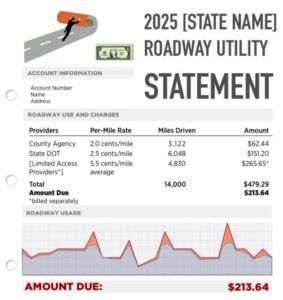

- Ensure that the MBUFs are simple, fair, customer-friendly, and analogous to the payment mechanisms for other utilities such as electricity and water supply.

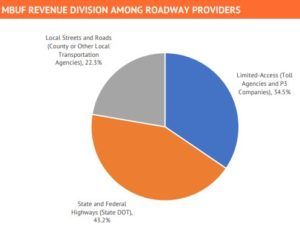

Given the need to experiment with different ways to structure MBUF systems the transition should be led by the states as they are more trusted on transportation than the federal government. About a dozen states are already considering tolling to finance reconstructing and modernizing the aging Interstate network. Since they handle 25% of all US vehicle-miles of travel (VMT), a state that converted its Interstates to per-mile electronic tolling would shift 25% of its VMT from per-gallon funding. Adding in other limited-access highways also suitable for transponder tolling could bring the total to nearly 35% of all VMT. This would get people used to paying per mile, and rebates of state fuel taxes for those miles would set a precedent for no one having to pay both fees as the transition to MBUFs proceeded to other roadways.

At the end of the transition from per-gallon to per-mile, direct customer-provider relationships would exist as follows:

At the end of the transition from per-gallon to per-mile, direct customer-provider relationships would exist as follows:

- Limited-access highways » Toll agencies and/or P3 concession companies;

- State highways » State DOT;

- Local roadways » County or other local transportation agencies.

This would provide a transparent system by which all vehicle users would know what they pay for each category of roads in their state, and who to hold accountable for road performance.